MBA 505 ECONOMICS AND PUBLIC POLICY

Chapter 25 MONEY AND COMMERCIAL BANKING

|

Key Words

| money |

Federal Deposit Insurance Corporation (FDIC) |

Quantity Theory of Money |

| liquid asset |

Eurocurrency markets |

velocity of money |

| currency substitution |

offshore banking |

FOMC directive |

| credit |

international banking facility (IBF) |

legal reserves |

| M1, M2, & M3 |

fractional reserve banking system |

federal funds rate |

| transactions account |

required reserves |

discount rate |

| international reserve account |

excess reserves |

open market operations |

| international reserve currency |

deposit expansion multiplier |

foreign exchange market intervention |

| Euro |

Federal Open Market Committee (FOMC) |

transactions demand |

| composite currency |

intermediate target |

precautionary demand |

| special drawing right (SDR) |

Gresham's Law |

speculative demand |

| sterilization |

equation of exchange |

|

|

|

| I. MONEY

A. Money is whatever is generally accepted for payment for goods and

services. Fur pelts and wampum beads are examples. The ancient Spartans

used iron for money because they wanted to discourage their warriors from

getting too involved in commerce and other peaceful activities. Traditionally

gold and silver were used as money, but today we use paper money.

B. Money has four functions:

1. As a medium of exchange, money is accepted in exchange

for goods and services. The ability of money to perform this function establishes

its ability to perform the other three.

a. In the absence of money, people exchanged goods and services directly.

This process is called barter. (People sometimes engage in barter

today to avoid paying sales tax.)

b. Barter requires a double coincidence of wants, where each

trader has exactly what the other one wants. This occurs only occasionally,

so barter is expensive.

2. Money serves as a unit of account, "an agreed measure

for stating the prices of goods and services."

3. Money is a store of value, so that it can be held for

a time and later exchanged for goods and services. Money must be durable

to serve this purpose, which is why head cheese, say, is not used for money.

4. Money is also a standard of deferred payment, used

as a measure for specifying future receipts and payments.

C. There are four kinds of money: commodity money, convertible paper

money, fiat money (the kind we use), and private debt money.

1. Commodity money is anything that is valued in its own

right and also used as a means of payment.

a. Because the commodity (usually gold or silver) is valued for its

own sake, the value of it as money is easily known. This is an advantage

of having a commodity money.

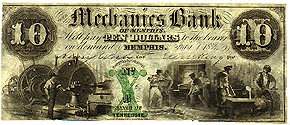

b. Clipping or debasing refer to reducing the value of the circulating

money by removing some of the valuable commodity from the coinage. Clipping

is what criminals do when they shave some gold or silver off the edge of

a coin. They spend the coin and keep the clipped fragments. Debasing

is when the government issues new coinage with less gold or silver in it

than the old coins of the same face value. Governments do this because

it's cheaper than putting the same amount of precious metal in the new

coins, and because it enables them to issue more coins for the same amount

of precious metal. Gresham's Law states that bad (debased) money

drives good (older, undebased) money out of circulation. People hoard the

old money because they know it is now worth more than its face value. These

are disadvantages of commodity money. (Note that no one clips the corners

off dollar bills.)

c. Another disadvantage of commodity money is that its use has an opportunity

cost because the commodity could be used for something else.

2. Convertible paper money is circulating paper money that can

be exchanged ("converted") into a commodity on demand.

a. When the amount of circulating paper money exceeds the stock of

commodity that backs it is called fractional backing. Fractional

backing enables more money to circulate, but if everyone demands the commodity

at the same time, a banking crisis occurs.

3. Fiat money is where the item used as money is intrinsically

worthless. Currency, the bills and coins used in the U.S. (and virtually

everywhere else,) is fiat money.

4. Private debt money is a "loan that the borrower promises

to repay in currency on demand." Checkable deposits, like your bank

or credit union account, are private debt money.

D. There are three measures of money in the U.S.: M1 includes

currency outside banks, traveler's checks, demand deposits, and other checkable

deposits; M2 includes M1 plus non-checkable savings deposits, small

time deposits, Eurodollar deposits, money market mutual fund shares held

by individuals, and some other deposits; M3 includes M2 plus large

time deposits, Eurodollar time deposits, all other money market mutual

fund shares, and some other deposits.

1. The items in M1 clearly meet the definition of money; the items

in M2 and M3 are a bit more distant, but are still quite liquid. Liquidity

measures the ease with which an asset is converted into money at a known

price.

2. Checkable deposits are money, but checks are not; they are merely

a mechanism for moving money from one person to another.

3. Credit cards are not money; they only enable the holder to get a

quick loan. Ultimately the loan must be repaid with money.

4. Debit cards are not money either; they operate just like checks.

|

|

II. FINANCIAL INTERMEDIARIES

A. Financial intermediaries (i.e., banks) accept deposits

from households and firms. They use the deposits to make loans to other

households and firms. There are five major types of financial intermediaries:

1. Commercial banks (chartered banks)

2. Savings and loan associations

3. Savings banks

4. Credit unions

5. Money market mutual funds

B. Commercial banks are private firms that receive deposits and

make loans. Traditionally, U.S. commercial banks were not permitted to

pay interest on their deposits, whereas savings banks and S&Ls were

not permitted to offer checking accounts, so normal people had most of

their money in a savings bank or S&L, and their checking account in

a commercial bank. Only businesses had very large checking account balances,

which is where the term commercial banks came from. Today the major difference

between commercial banks and savings banks are in their loan portfolios.

Commercial banks make loans to businesses, often for short periods of time.

Savings banks and S&Ls make most of their loans to individuals buying

homes.

C. The best way to understand the operations of a commercial bank is

to look at its balance sheet.

1. The balance sheet is an accounting statement listing the things

a firm owns (its assets,) and what it owes to others (its liabilities.)

2. The major liabilities of a bank are the deposits it has accepted.

These include checkable deposits, savings deposits (though today most are

checkable), and time deposits (e.g., C.D.s). 3. The major assets of a bank

are its reserves, investment securities, liquid assets (short-term loans),

and loans.

a. Reserves consist of cash in the bank's vault and deposits

held at the Federal Reserve Bank. Basically, these are deposits which are

not being invested or loaned out.

b. Investment securities are stocks and bonds that can be sold

quickly but whose price fluctuates.

c. Loans are commitments where the bank lends a fixed amount

of money for a fixed time period.

D. Financial intermediaries make a profit from the difference between the

interest rate paid by them on deposits and the interest rate charged by

them on loans. This spread exists because banks provide four services.

(Right now the spread is artificially high.)

1. Banks minimize the cost of obtaining funds by pooling many

people's relatively small deposits into large sums that can be loaned to

many borrowers.

2. Banks minimize the cost of monitoring borrowers by specializing

in this activity.

3. By loaning to many different borrowers banks pool risk so

that if one borrower is unable to pay back the loan the lender loses only

a small fraction of his or her total deposits.

4. Financial intermediaries create liquidity by accepting deposits

that can be instantly withdrawn and using these deposits to make long-lived

loans.

|

|

| III. FINANCIAL REGULATION, DEREGULATION, AND INNOVATION

A. Financial intermediaries face two types of restrictions: deposit

insurance and balance sheet rules.

1. Deposits at U.S. banks and S&Ls are insured by the Federal

Deposit Insurance Corporation (FDIC). This insurance guarantees that

depositors are protected for up to $100,000 per depositor. This gives the

banks the incentive to make risky loans since the depositors see their

funds as perfectly safe. Because of this incentive there are balance sheet

rules. Insured banks pay a very small percentage of their insured deposits

into a fund to cover this protection. In addition, if the fund were ever

depleted, the government (i.e., the taxpayers) is pledged to pay for any

claims resulting from bank failures.

2. There are three main balance sheet rules:

a. Capital requirements - regulations setting the minimum amount

of the owners' own money that must be at stake in the financial intermediary.

This is the amount of money you would need to start up your own bank. Since

you would lose this money if your bank fails, the capital requirements

encourage you to run your bank in a responsible manner. If you are irresponsible,

you lose along with your depositors.

b. Reserve requirements - rules listing the minimum percentages

of deposits that must be held as currency or other safe assets. The bank

will use its reserves to cover withdrawals when there is a run on the bank.

The higher a bank's reserves, the worse a bank run it can survive.

c. Lending rules - restrictions on the size and type of loans

the bank can make. Some kinds of very risky loans are forbidden.

B. The 1980s were marked by financial deregulation, when changes

lifted many of the restrictions on financial intermediaries.

C. The 1980s also were marked by financial innovation, when the

development of new financial products was aimed at lowering the cost of

making loans and at raising the return on deposits. Financial innovation

occurred for three reasons:

1. The economic environment of the early 1980s featured high

inflation and high interest rates, which created risk for intermediaries.

Some innovations, like adjustable-rate mortgages, were aimed at lowering

this risk.

2. Massive technological change, like e.g. reductions in the

cost of computing and long-distance communication, caused other innovations.

3. Much innovation was aimed at avoiding regulation.

|

|

| IV. HOW BANKS CREATE MONEY

A. The fraction of a bank's total deposits held as reserves is

the reserve ratio. This must be a certain level due to the reserve

requirements, but for many banks it is higher. The required reserve

ratio is the fraction that banks are required, by regulation, to keep

as reserves. Required reserves are the total amount of reserves

banks are required to keep. Excess reserves equal actual reserves

minus required reserves.

B. When a bank receives additional currency in the form of new deposits,

its total reserves rise by the entire amount of the deposit, but its required

reserves rise by only a fraction of the new deposit (the required reserve

ratio). Thus excess reserves increase. The bank loans out (some

or all of) its excess reserves. These loans end up as deposits in other

banks, where the new deposits boost the other banks' total reserves by

more than the other banks' required reserve ratios. These banks

then loan out their excess reserves and the process continues. Thus

many banks end up with extra deposits to loan out and it is through this

process that banks create money. (But remember - it takes money

to make money.)

C. The Deposit Expansion Multiplier(DEM) is the "amount by

which an increase in bank reserves is multiplied to calculate the effect

of the increase in reserves on total bank deposits." The DEM equals 1/(required

reserve ratio).

D. The real world money multiplier is smaller than the theoretical

DEM because not all loans made by banks end up as deposits in other banks.

Apparently some people deposit this money in their mattresses.

|

|

| V. THE QUANTITY THEORY OF MONEY

A. The quantity theory of money asserts that an increase

in the quantity of money in circulation leads to an equal percent increase

in the price level.

B. Key to the quantity theory is the equation of exchange,

MV = PQ, where M = money supply, V = the velocity of circulation,

P = the price level, and Q = real GDP.

1. The velocity of circulation or velocity of money

is the average number of times in a year a dollar is used to purchase goods

and services in GDP.

C. The quantity theory assumes that velocity is constant and that real

GDP is not affected by the quantity of money. Hence P = (V/Q) x M where

(V/Q) is constant. This is called the quantity of money theory of prices.

Looking at this in first differences, D P =

(V/Q) x D M so that D

P/P = D M/M, i.e., the inflation rate equals

the growth rate of the money supply.

D. The quantity theory implicitly assumes the aggregate supply curve

is always vertical, i.e., since the LRAS is vertical, the quantity

theory is a theory of long run changes in the price level.

E. Historical U.S. evidence on the quantity theory of money gives four

results:

1. On average, the growth rate of the money supply exceeds the inflation

rate. (This is because Q, real GDP, is not constant, but grows in the long

run.)

2. The correlation between the money growth rate and the inflation rate

is most evident between 1915 and 1940. After that the correlation, though

positive, has been much weaker.

3. During WWI, a massive increase in the growth rate of the money supply

was associated with a large increase in the inflation rate. This was less

true during WWII.

4. Money growth is more volatile than the inflation rate.

F. International evidence shows a large tendency for high money growth

rates to be associated with high inflation rates.

|

|

VI. THE DEMAND FOR MONEY

A. People have three reasons for demanding money, (i.e., for wanting

to hold money):

1. The transactions motive refers to the fact that people

want money to use to buy things.

2. Money is held as a precaution against unexpected events that require

unplanned purchases. This is the precautionary motive for

demanding. "Mad money" illustrates the precautionary motive.

3. The speculative motive refers to holding money to avoid

losses from holding stocks and bonds that may fall in price.

B. The price level, the level of real GDP,

and the interest rate all affect the aggregate quantity of

nominal money demanded.

1. Nominal money is the amount of money measured in

current dollars. The quantity of nominal money demanded is proportional

to the price level - a 10% increase in the price level raises the quantity

of nominal money demanded by 10%.

2. The higher real GDP, the more transactions are undertaken. Therefore,

an increase in real GDP increases the demand for money.

3. The interest rate is the opportunity cost of holding wealth in the

form of money rather than an interest-bearing asset. Therefore, an increase

in the interest rate reduces the aggregate quantity of nominal money demanded.

C. The demand for real money is "the relationship between

the quantity of real money demanded (M/P) and the interest, holding constant

all other influences."

1. The negative slope of the demand curve reflects the role of the

interest rate as the opportunity cost of demanded money. At high interest

rates, people hold their wealth in bonds or treasury bills. At low interest

rates they hold their wealth in money.

2. The demand curve for real money balances shifts if real income

(real GDP) changes or if financial innovation occurs.

a. An increase in real income shifts the demand curve for real balances

to the right.

b. Financial innovation that allows low cost shifting between money

and interest-bearing assets reduces the demand for real money and shifts

the demand curve to the left.

D. The velocity of circulation (V) = (Q))(M/P).

(M/P) is the quantity of real money, so if an increase in the interest

rate reduces the quantity of real money demanded, velocity should increase.

This agrees with data for the U.S.

|

|

|

GRESHAM'S LAW

|