| 6. |

| (Advanced analysis) Answer the next question(s) on

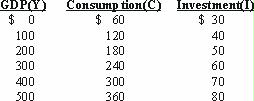

the basis of the following data. The letters Y, C, S,

and I are used to represent GDP, consumption, saving, and investment

respectively.

|

| R-4 REF09188 |

The equation representing the consumption schedule for the above economy

is:

|