| ECON 232 Chapter 8 MACROECONOMIC INSTABILITY: UNEMPLOYMENT AND INFLATION |

| This chapter previews economic growth, the business cycle, unemployment,

and inflation. It sets the stage for the analytical presentation

in later chapters.

Economic growth is defined and the arithmetic and sources of economic

growth are examined. The record of growth in the U.S. is viewed from

several perspectives including an international comparison in Global Perspective.

The business cycle is introduced in historical perspective and is presented

in stylized form (Figure 8?1). While hinting at various business

cycle theories, the authors stress the general belief that changes in aggregate

spending, especially durable goods and investment spending, are the immediate

cause of economic instability. Non-cyclical fluctuations are also

treated briefly before the analysis of unemployment and inflation.

In the section on unemployment, the various types of unemployment—frictional,

structural, and cyclical—are described. Then the problems involved

in measuring unemployment and in defining the full?employment unemployment

rate are considered. The economic and non-economic costs of unemployment

are presented, and finally, Global Perspective 8-2 gives an international

comparison of unemployment rates.

Inflation is accorded a rather detailed treatment from both a cause

and an effect perspective. International comparisons of inflation

rates in the post-1983 period are given in Global Perspective 8-3.

Demand?pull and cost?push inflation are described. Considerable emphasis

is placed on the fact that the redistributive effects of inflation will

differ, depending on whether inflation is anticipated or unanticipated.

The chapter ends with historical cases of extreme inflation to remind students

that inflationary fears have some basis in fact. |

| I. Introduction: This chapter provides an introductory

look at trends of real GDP growth and the macroeconomic problems of the

business cycle, unemployment and inflation. |

II. Economic Growth-how to increase the economy’s

productive capacity over time.

A. Two definitions of economics growth are given.

1. The increase in real GDP, which occurs over a period of time.

2. The increase in real GDP per capita, which occurs over time.

This definition is superior if comparison of living standards is desired.

For example, China’s GDP is $744 billion compared to Denmark’s $155 billion,

but per capita GDP’s are $620 and $29,890 respectively.

B. Growth is an important economic goal because it means more material

abundance and ability to meet the economizing problem. Growth lessens

the burden of scarcity.

C. The arithmetic of growth is impressive. Using the “rule of

70,” a growth rate of 2 percent annually would take 35 years for GDP to

double, but a growth rate of 4 percent annually would only take about 18

years for GDP to double. (The “rule of 70” uses the absolute value

of a rate of change, divides it into 70, and the result is the number of

years it takes the underlying quantity to double.)

D. Main sources of growth are increasing inputs or increasing productivity

of existing inputs.

1. About one-third of U.S. growth comes from more inputs.

2. About two-thirds comes from increased productivity.

E. Growth Record of the United States (Table 8-1) is impressive.

1. Real GDP has increased more than sixfold since 1940, and real

per capita GDP has risen almost fourfold. (See columns 2 and 4, Table

8-1)

2. Rate of growth record shows that real GDP has grown 3.1 percent

per year since 1950 and real GDP per capita has grown about 2 percent per

year. But the arithmetic needs to be qualified.

a. Growth doesn’t measure quality improvements.

b. Growth doesn’t measure increased leisure time.

c. Growth doesn’t take into account adverse effects on environment

or human security.

d. International comparisons are useful in evaluating U.S. performance.

For example, Japan grew more than twice as fast as U.S. until the 1990s

when the U.S. far surpassed Japan. (see Global Perspective 8-1).

|

The NRA was part of the Roosevelt administration's efforts to respond

to the Great Depression. The National Industrial Recovery Act set

up the National Recovery Administration, in which participating firms agreed

to fix prices at higher than market levels in an effort to enable the firms

to support higher levels of employment. The NRA was declared unconstitutional

by the Supreme Court.

The NRA was part of the Roosevelt administration's efforts to respond

to the Great Depression. The National Industrial Recovery Act set

up the National Recovery Administration, in which participating firms agreed

to fix prices at higher than market levels in an effort to enable the firms

to support higher levels of employment. The NRA was declared unconstitutional

by the Supreme Court. |

III. Overview of the Business Cycle

A. Historical record:

1. The United States’ impressive long-run economic growth has been

interrupted by periods of instability.

2. Uneven growth has been the pattern, with inflation often accompanying

rapid growth, and declines in employment and output during periods of recession

and depression (see Figure 8?1 and Table 8-2).

B. Four phases of the business cycle are identified over a several-year

period. (See Figure 8-1)

1. A peak is when business activity reaches a temporary maximum with

full employment and near-capacity output.

2. A recession is a decline in total output, income, employment, and

trade lasting six months or more.

3. The trough is the bottom of the recession period.

4. Recovery is when output and employment are expanding toward full?employment

level.

C. There are several theories about causation.

1. Major innovations may trigger new investment and/or consumption

spending.

2. Changes in productivity may be a related cause.

3. Most agree that the level of aggregate spending is important, especially

changes on capital goods and consumer durables.

D. Cyclical fluctuations: Durable goods output is more unstable

than non-durables and services because spending on latter usually cannot

be postponed.

|

A Civil-War era postage stamp used as money in a brass or copper cover.

Because of high inflation, people hoarded coins for their metal value.

The U.S. Treasury attempted to satisfy the need for money with paper fractional

currency. Private business people bought postage stamp covers, with

an advertisement for their business on the back, to protect stamps

used to make change. The public's need for money was partly satisfied,

and the businesses benefited from the advertising.

A Civil-War era postage stamp used as money in a brass or copper cover.

Because of high inflation, people hoarded coins for their metal value.

The U.S. Treasury attempted to satisfy the need for money with paper fractional

currency. Private business people bought postage stamp covers, with

an advertisement for their business on the back, to protect stamps

used to make change. The public's need for money was partly satisfied,

and the businesses benefited from the advertising. |

IV. Unemployment (One Result of Economic Downturns)

A. Types of unemployment:

1. Frictional unemployment consists of those searching for jobs

or waiting to take jobs soon; it is regarded as somewhat desirable, because

it indicates that there is mobility as people change or seek jobs.

2. Structural unemployment: due to changes in the structure

of demand for labor; e.g., when certain skills become obsolete or geographic

distribution of jobs changes.

a. Glass blowers were replaced by bottle-making machines.

b. Oil-field workers were displaced when oil demand fell in 1980s.

c. Airline mergers displaced many airline workers in 1980s.

d. Foreign competition has led to downsizing in U.S. industry and loss

of jobs.

e. Military cutbacks have led to displacement of workers in military-related

industries.

3. Cyclical unemployment is caused by the recession phase of

the business cycle, which is sometimes called deficient demand unemployment.

B. Definition of “Full Employment”

1. Full employment does not mean zero unemployment.

2. The full?employment unemployment rate is equal to the total frictional

and structural unemployment.

3. The full?employment rate of unemployment is also referred to as

the natural rate of unemployment.

4. The natural rate is achieved when labor markets are in balance;

the number of job seekers equals the number of job vacancies. At

this point the economy’s potential output is being achieved. The

natural rate of unemployment is not fixed, but depends on the demographic

makeup of the labor force and the laws and customs of the nations.

The recent drop in the natural rate from 6% to 5.5% has occurred mainly

because of the aging of the work force and increased competition in product

and labor markets.

5. The natural rate of unemployment is not fixed but depends on the

demographic makeup of the labor force and the laws and customs of the nations.

6. The recent drop in the natural rate of 6% to 5.5% has occurred mainly

because of the aging of the work force and increased competition in product

and labor markets.

C. Measuring unemployment (see Figure 8-4 for 1994):

1. The population is divided into three groups: those under age

16 or institutionalized, those “not in labor force,” and the labor force

that includes those age 16 and over who are willing and able to work.

2. The unemployment rate is defined as the percentage of the labor

force that is not employed.

3. The unemployment rate is calculated by random survey of 60,000 households

nationwide.

a. Part?time workers are counted as “employed.”

b. “Discouraged workers” who want a job, but are not actively seeking

one, are not counted as being in the labor force, so they are not part

of unemployment statistic.

D. Economic cost of unemployment:

1. GDP gap and Okun’s Law: GDP gap is the difference between

potential and actual GDP. (See Figure 8-5) Economist Okun quantified

relationship between unemployment and GDP as follows: For every

1 percent of unemployment above the natural rate, a 2 percent GDP gap occurs.

This has become known as “Okun’s law.”

2. Unequal burdens of unemployment exist. (See Table 8-2)

a. Rates are lower for white-collar workers.

b. Teenagers have the highest rates.

c. Blacks have higher rates than whites.

d. Rates for males and females are comparable, though females had a

lower rate in 1992.

e. Less educated workers, on average, have higher unemployment rates

than workers with more education.

f. “Long-term” (15 weeks or more) unemployment rate is much lower than

the overall rate.

E. Noneconomic costs include loss of self-respect and social and political

unrest.

F. International comparisons. (See Global Perspective 8-1)

Foreign countries usually have higer unemployment rates than the U.S.

For industrialized countries, this is partly attributable to the higher

level of unemployment and social benefits workers receive in those countries.

|

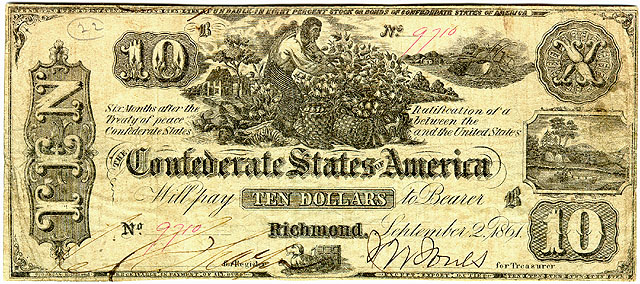

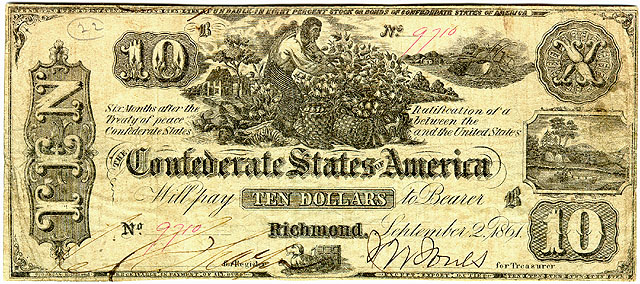

This Confederate ten dollar note promised to pay eight percent interest,

intended to offset the high inflation experienced during the Civil War.

The note was not redeemable on demand, but was supposed to be payable six

months after the ratification of a peace treaty between the Confederate

States and the United States. The Confederate government accepted

these notes in payment for all taxes, except export duties which could

only be paid in gold or foreign currency. The inflation rate soon

exceeded eight percent, and these notes quickly became worthless.

Note the hand-written serial number and signatures. The September

2, 1861 date is the date of the authorizing legislation, not the actual

date of issue, though judging from the serial number, this note was probably

issued fairly early in the war.

This Confederate ten dollar note promised to pay eight percent interest,

intended to offset the high inflation experienced during the Civil War.

The note was not redeemable on demand, but was supposed to be payable six

months after the ratification of a peace treaty between the Confederate

States and the United States. The Confederate government accepted

these notes in payment for all taxes, except export duties which could

only be paid in gold or foreign currency. The inflation rate soon

exceeded eight percent, and these notes quickly became worthless.

Note the hand-written serial number and signatures. The September

2, 1861 date is the date of the authorizing legislation, not the actual

date of issue, though judging from the serial number, this note was probably

issued fairly early in the war. |

V. Inflation: Defined and Measured

A. Definition: Inflation is a rising general level of

prices (not all prices rise at the same rate, and some may fall).

A mathematical definition of inflation is the percent increase in a measure

of the price level, such as the CPI or GDP deflator, from one year to the

next.

B. To measure inflation, subtract last year’s price index from this

year’s price index and divide by last year’s index; then multiply by 100

to express as a percentage.

C. “Rule of 70” permits quick calculation of the time it takes the price

level to double: Divide 70 by the percent rate of inflation and the

result is the approximate number of years for the price level to double.

If the inflation rate is 10 percent, then it will take about ten years

for prices to double. (Note: You can also use this rule to calculate

how long it takes savings to double at a given compounded interest rate.)

D. Facts of inflation:

1. In the past, deflation has been as much a problem as inflation.

For example, the 1930s depression was a period of declining prices and

wages.

2. All industrial nations have experienced the problem (see Global

Perspective 8-2).

3. Some nations experience astronomical rates of inflation (Angola’s

was 4,145 percent in 1996).

4. The inside covers of the text contain historical rates for the U.S.

E. Causes and theories of inflation:

1. Demand-pull inflation: Spending increases faster than production.

(See Figure 8-7) Inflation will occur in range 2 and range 3 of this

illustration. Bottlenecks occur in some industries in range 2, and

output cannot expand to meet demand in these industries so producers raise

prices; in Range 3 full employment has been reached and resource prices

will rise with increasing demand, causing producers to raise prices.

Note: Chapter 7’s distinction between nominal and real GDP is helpful

here.

2. Cost-push or supply-side inflation: Prices rise because of

rise in per-unit production costs (Unit cost = total input cost/units of

output).

a. Wage-push can occur as result of union strength.

b. Supply shocks may occur with unexpected increases in the price of

raw materials.

3. Complexities: It is difficult to distinguish between demand-pull

and cost-push causes of inflation, although cost-push will die out in a

recession if spending does not also rise.

|

|

VI. Redistributive effects of inflation:

A. Fixed-income groups will be hurt because their real income

suffers. Their nominal income does not rise with prices.

B. Savers will be hurt by unanticipated inflation, because interest

rate returns may not cover the cost of inflation. Their savings will

lose purchasing power.

C. Debtors (borrowers) can be helped and lenders hurt by unanticipated

inflation. Interest payments may be less than the inflation rate,

so borrowers receive “dear” money and are paying back “cheap” dollars that

have less purchasing power for the lender.

D. If inflation is anticipated, the effects of inflation may be less

severe, since wage and pension contracts may have inflation clauses built

in, and interest rates will be high enough to cover the cost of inflation

to savers and lenders.

1. “Inflation premium” is amount that interest rate is raised to cover

effects of anticipated inflation.

2. “Real interest rate” is defined as nominal rate minus inflation

premium. (See Figure 8-6)

E. Final points

1. Unexpected deflation, a decline in price level, will have the opposite

effect of unexpected inflation.

2. Many families are simultaneously helped and hurt by inflation because

they are both borrowers and earners and savers.

3. Effects of inflation are arbitrary, regardless of society’s goals.

4. See Quick Review 8-4.

|

|

VII. Output Effects of Inflation

A. Cost-push inflation, where resource prices rise unexpectedly,

could cause both output and employment to decline. Real income falls.

B. Mild inflation (<3%) has uncertain effects. It may be a

healthy by-product of a prosperous economy, or it may have an undesirable

impact on real income.

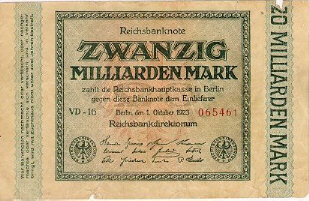

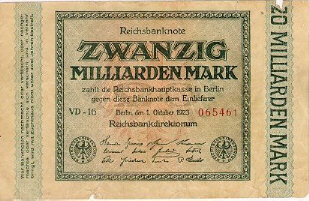

C. Danger of creeping inflation turning into hyperinflation, which can

cause speculation, reckless spending, and more inflation (see examples

in text of Hungary and Japan following World War II, and Germany following

World War I).

|

|

VIII. LAST WORD: The Stock Market and The

Economy:

How, if at all, do changes in stock prices relate to macroeconomic

stability?

A. Do changes in stock prices and stock market wealth cause

instability? The answer is yes, but usually the effect is weak.

1. There is a wealth effect: Consumer spending rises as asset

values rise and vice versa if stock prices decline substantially.

2. Also, there is an investment effect: Rising share prices lead

to more capital goods investment and the reverse in true for falling share

prices.

B. Stock market “bubbles” can hurt the economy by encouraging reckless

speculation with borrowed funds or savings needed for other purposes.

A “crash” can cause unwarranted pessimism about the underlying economy.

C. A related question concerns forecasting value of stock market averages.

Stock price averages are included as one of ten “Leading Indicators” used

to forecast the future direction of the economy. (See Last Word,

Chapter 12). However, by themselves, stock values are not a reliable

predictor of economic conditions.

|