|

Robert F. Mulligan,

Ph.D. |

|

|

ECON 232 CHAPTER THIRTEEN MONEY AND BANKING |

|

Chapters 13, 14, and 15 form a conventional unit on money and banking. These chapters provide the foundation for the discussion of modern monetary theory and for the discussion and analysis of the monetarist and competing theories which follow. Chapter 13 introduces the U.S. financial system. The chapter first covers the nature and functions of money and then discusses the Federal Reserve System’s definition of the money supply. Next, the chapter addresses the question of what “backs” money by looking at the value of money, money and prices, and the management of the money supply. The demand for money is then covered, and it is followed by an introduction and discussion of the money market. Finally, there is a rather comprehensive description of the U.S. financial system, which focuses on the features and functions of the Federal Reserve System and recent difficulties in the U.S. financial system. |

|

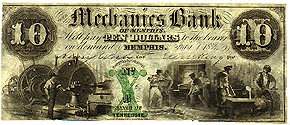

This bank note was issued by the Mechanics Bank of Memphis, Tennesee. The bank was obliged to pay the bearer ten dollars in silver or gold coin if the note was presented at the bank. |

|

I. Functions of Money A. Medium of exchange: Money can be used for buying and selling goods and services. B. Unit of account: Prices are quoted in dollars and cents. C. Store of value: Money allows us to transfer purchasing power from present to future. It is the most liquid (spendable) of all assets, a convenient way to store wealth. |

|

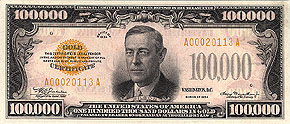

This gold certificate never circulated. It was only used to transfer funds among banks. |

|

II. Supply of Money A. Narrow definition of

money: M1 includes currency and checkable deposits (see

Table 13-1). B. Money Definition: M2 = M1 + some near-monies which include: (See Table 13-1) 1. Savings deposits and

money market deposit accounts.

D. Which definitions are

used? M1 will be used in this text, but M2 is watched closely by the

Federal Reserve in determining monetary policy. E. Credit cards are not money, but their use involves short-term loans; their convenience allows you to keep M1 balances low because you need less for daily purchases. |

|

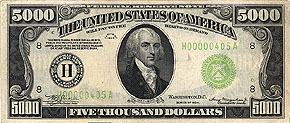

This Federal Reserve note was also used only for transfers among banks. It depicts James Madison, author of the U.S. Constitution and Bill of Rights. Note the very low serial number. |

|

III. What “backs” the money supply? A. The government’s ability to keep its value stable provides the backing. B. Money is debt; paper money is a debt of Federal Reserve Banks and checkable deposits are liabilities of banks and thrifts because depositors own them. C. Value of money arises not

from its intrinsic value, but its value in exchange for goods and

services. D. Money’s purchasing power determines its value. Higher prices mean less purchasing power. (Key Question #6) (See Figure 13-1) E. Excessive inflation may make

money worthless and unacceptable. An extreme example of this was German

hyperinflation after World War I, which made the mark worth less than 1

billionth of its former value within a four-year period. F. Maintaining the value of

money |

|

This silver certificate was issued directly by the U.S. Treasury. The allegorical figure in the center is holding up an electric light bulb, a new wonder of this modern age. It is unusual that the front of the certificate is printed in green. |

|

IV. The Demand for Money : Two Components A. Transactions demand, Dt, is money kept for purchases and will vary directly with GDP (Figure 13-1a). B. Asset demand, Da, is money kept as a store of value for later use. Asset demand varies inversely with the interest rate, since that is the price of holding idle money (Figure 13-1b). C. Total demand will equal quantities of money demanded for assets plus that for transactions (Figure 13-1c). |

|

This bank note was issued by the National Bank of Commerce of Houston, Texas. The design was nationally standardized under the National Bank Act, but the name of the issuing bank is right on the bill. After 1913, only the twelve federal reserve banks were permitted to issue bank notes. The U.S. Treasury continued to issue gold certificates, silver certificates, and U.S. notes, but has since stopped. |

|

V. The Money Market: Interaction of Money Supply and Demand A. Key Graph 13-1c illustrates the money market. It combines demand with supply of money. B. Figure 13-2 illustrates how equilibrium changes with a shift in the supply of money. C. If the quantity demanded exceeds the quantity supplied, people sell assets like bonds to get money. This causes bond supply to rise, bond prices to fall, and a higher market rate of interest. D. If the quantity supplied exceeds the quantity demanded, people reduce money holdings by buying other assets like bonds. Bond prices rise, and lower market rates of interest result (see example in text). E. Monetary authorities can shift supply to affect interest rates, which in turn affect investment and consumption and aggregate demand and, ultimately, output, employment, and prices. (Key Question #7) F. Try Quick Quiz 13-2. |

|

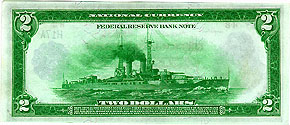

This is one of the first Federal Reserve notes from 1913, which says "Federal Reserve Bank Note" and "National Currency." It came out shortly before World War I started in Europe and is known as the national defense issue, even though the U.S. remained neutral until 1917. Jefferson's portrait and the treasury seal can be seen through on the front. The ship is a brand new New York class battleship, either the New York or the Texas. Both ships fought in both world wars. Heavily modified as air defense battleships in World War II, they were used for amphibious assault in the Pacific. The U.S.S. Texas has been preserved as a war memorial in San Jacincto, Texas. The New York was used as an atom bomb target at Bikini in 1948. Note the extensive small print in the block at the bottom, spelling out some technicalities of the new Federal Reserve System. |

|

VI. The Federal Reserve and the Banking System A. The Federal Reserve System

(the “Fed”) was established by Congress in 1913 and holds power over the

money and banking system. B. Functions of the Fed and

money supply: C. Federal Reserve independence is important but is also controversial from time to time. Advocates of independence fear that more political ties would cause the Fed to follow expansionary policies and create too much inflation, leading to an unstable currency such as that in other countries (see Last Word for this chapter). |

|

The treasury seal, serial numbers, and probably the whole reverse of this gold certificate are printed in gold-orange. |

|

VII. Recent Developments in Money and Banking A. Relative decline of banks and thrifts: Several other types of firms offer financial services. B. Consolidation among banks and thrifts: Because of failures and mergers, there are fewer banks and thrifts today. Since 1990, there has been a decline of 5000 banks. C. Convergence of services provided has made financial institutions more similar: See text on new laws of 1996 and 1999 that made many changes possible. D. Globalization of financial markets: Significant integration of world financial markets is occurring and recent advances in computer and communications technology suggest the trend is likely to accelerate. E. Electronic transactions:

Internet buying and selling, electronic cash and “smart cards” are

examples. |

|

This form of money, a "compound interest treasury note," was issued by the U.S. Treasury late in the Civil War. To get people to accept paper money in a high inflation environment, the government had to offer interest. |

|

VIII. LAST WORD: The Global Greenback A. Two-thirds of all U.S.

currency is circulating abroad. B. U.S. profits when dollars stay overseas: It costs us 4¢ to print each dollar and to get the dollar; foreigners must sell Americans $1 worth of products. Americans gain 96¢ over cost of printing the dollar. It’s like someone buying a travelers check and never cashing it. C. Black markets and illegal activity overseas also are usually conducted in dollars because they are such a stable form of currency. D. Overall, the “global greenback” is a positive economic force. It is a reliable medium of exchange, measure, and store of value that facilitates transactions everywhere and there is little danger that all the dollars will return to U.S. |

|

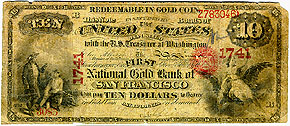

This gold certificate was issued by a private bank instead of the government. It was issued by the First National Gold Bank of San Francisco during the California gold rush. The bank had to deposit gold coins in the U.S. Treasury in Washington to back each certificate. |