ECON

303 Chapter 18 Study Quiz

1) The objectives of the Federal Reserve in its conduct of monetary policy include

(a) economic growth.

(b) price stability.

(c) high employment.

(d) all of the above.

Answer: D

2) If the central bank’s strategy for conducting monetary policy is thought of as a game plan that proceeds in stages, then the game plan can be summarized as follows:

(a) The central bank selects its policy goals, then the intermediate targets consistent with achieving its policy goals, then the operating targets consistent with its intermediate targets; finally, it adjusts its policy tools to affect the desired targets and goals.

(b) The central bank selects its policy goals, then the operating targets consistent with achieving its policy goals, then the intermediate targets consistent with its operating targets; finally, it adjusts its policy tools to affect the desired targets and goals.

(c) The central bank selects its policy tools, then its intermediate targets consistent with its policy tools, then the operating targets consistent with the intermediate targets; finally, it adjusts its policy goals to affect the desired targets and tools.

(d) The central bank selects its policy tools, then the operating targets consistent with achieving its policy tools, then the intermediate targets consistent with its operating targets; finally, it adjusts its policy goals to affect the desired targets and tools.

(e) None of the above.

Answer: A

3) Which of the following is not an operating target?

(a) Nonborrowed reserves

(b) Monetary base

(c) Federal funds interest rate

(d) Discount rate

(e) All are operating targets

Answer: D

4) Due to the lack of timely data for the price level and economic growth, the Fed’s strategy

(a) targets the exchange rate, since the Fed can control this variable.

(b) targets the price of gold, since it is closely related to economic activity.

(c) uses an intermediate target, such as an interest rate.

(d) stabilizes the consumer price index, since the Fed can control the CPI.

(e) has been to abandon policy goals.

Answer: C

5) An advantage of an intermediate targeting strategy is that it provides the central bank with

(a) more timely information regarding the effect of monetary policy.

(b) a slow adjustment process.

(c) a target that is precisely correlated with economic activity.

(d) each of the above.

(e) only (a) and (b) of the above.

Answer: A

6) If the central bank targets a monetary aggregate, it is likely to lose control over the interest rate because

(a) of fluctuations in the money demand function.

(b) of fluctuations in the consumption function.

(c) bond values will tend to remain stable.

(d) of fluctuations in the business cycle.

Answer: A

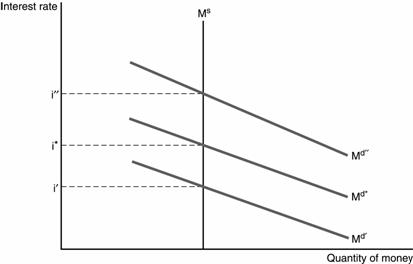

Figure 18-1

7) Referring to Figure 18-1, fluctuations in money demand between Md˘ and Md˘˘ cause

(a) fluctuations of the money supply.

(b) the interest rate to remain stable at i*.

(c) interest rate fluctuations between i* and i˘˘.

(d) interest rate fluctuations between i˘ and i˘˘.

(e) none of the above.

Answer: D

8) Figure 18-1 depicts a situation of

(a) interest rate stability.

(b) stability of money demand.

(c) instability of money supply.

(d) interest rate instability.

(e) none of the above.

Answer: D

9) In Figure 18-1, the central bank is targeting

(a) the interest rate.

(b) the money supply.

(c) money demand.

(d) all of the above.

(e) none of the above.

Answer: B

10) If the Fed pursues a strategy of targeting an interest rate when fluctuations in money demand are prevalent,

(a) fluctuations in the money supply will be small.

(b) fluctuations in the money supply will be large.

(c) the Fed will probably quickly abandon this policy, as it did in the 1960s.

(d) the Fed will probably quickly abandon this policy, as it did in the 1950s.

Answer: B

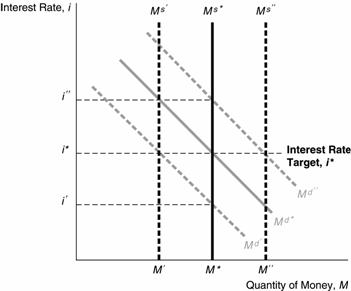

Figure 18-2

11) Referring to Figure 18-2, if the central bank wishes to keep the interest rate at the target value i*, it must

(a) increase the money supply to Ms˘˘ when money demand increases to Md˘˘.

(b) allow the interest rate to increase when money demand increases.

(c) hold the money supply constant at Ms* when money demand falls to Md˘.

(d) allow the interest rate to decrease when money demand decreases.

(e) none of the above.

Answer: A

12) Referring to Figure 18-2, an interest rate target requires that the central bank

(a) increase the money supply when money demand falls.

(b) increase the money supply when interest rates fall.

(c) reduce the money supply when money demand increases.

(d) reduce the money supply when interest rates fall.

(e) hold the money supply constant when money demand changes.

Answer: D

13) Referring to Figure 18-2, when money demand fluctuates between Md˘ and Md˘˘, a policy of interest rate targeting results in

(a) interest rate fluctuations between i˘ and i˘˘.

(b) money supply fluctuations between Ms˘ and Ms˘˘.

(c) interest rate fluctuations between i* and i˘˘.

(d) money supply fluctuations between M* and Ms˘˘.

(e) no fluctuations in either the interest rate or money supply.

Answer: B

14) Referring to Figure 18-2, the target interest rate i* is attained when

(a) money demand is Md* and the money supply is Ms˘.

(b) money demand is Md˘ and the money supply is Ms˘.

(c) money demand is Md˘ and the money supply is Ms*.

(d) money demand is Md* and the money supply is Ms˘˘.

(e) money demand is Md˘˘ and the money supply is Ms*.

Answer: B

15) Interest rates are difficult to measure because

(a) data on them are not timely available.

(b) real interest rates depend on the hard-to-determine expected inflation rate.

(c) they fluctuate too often to be accurate.

(d) they cannot be controlled by the Fed.

Answer: B

16) The Fed’s policy of rediscounting eligible paper to keep interest rates low in order to help the Treasury finance World War I caused

(a) inflation to accelerate.

(b) aggregate output to decline sharply.

(c) the Fed to rethink the efficacy of the real bills doctrine.

(d) both (a) and (b) of the above.

(e) both (a) and (c) of the above.

Answer: E

17) The Federal Reserve’s lack of response to banking panics during the Great Depression can be attributed to

(a) lack of concern for the smaller banks that experienced most of the failures.

(b) the assumption that failures were due to bad practices or management.

(c) political infighting within the Federal Reserve System.

(d) all of the above.

(e) none of the above.

Answer: D

18) The Fed’s mistakes of the early 1930s were compounded by its decision to

(a) raise the discount rate in 1936–1937.

(b) raise reserve requirements in 1936–1937.

(c) lower reserve requirements in 1936–1937.

(d) raise the monetary base in 1936–1937.

(e) lower the monetary base in 1936–1937.

Answer: B

19) Targeting interest rates can be procyclical because

(a) a decrease in income decreases interest rates, causing the Fed to sell bonds, decreasing the monetary base and money supply, leading to further decreases in income.

(b) a decrease in interest rates decreases income, causing the Fed to sell bonds, decreasing the monetary base and money supply, leading to further decreases in income.

(c) a decrease in the monetary base decreases the money supply, causing the Fed to sell bonds, decreasing the monetary base and money supply, leading to further decreases in income.

(d) a decrease in income decreases the monetary base and money supply, causing the Fed to sell bonds to decrease interest rates and income.

(e) none of the above.

Answer: A

20) The Fed’s use of the _____ as an operating target in the 1970s resulted in _____ monetary policy.

(a) federal funds rate; countercyclical

(b) federal funds rate; procyclical

(c) M1 money supply; countercyclical

(d) M1 money supply; procyclical

Answer: B

Question Status: Revised

21) Fed policy between October 1982 and the early 1990s indicates that

(a) interest rate targeting finally gave way to a strategy of targeting the monetary base.

(b) it was pursuing a policy of interest rate targeting.

(c) it was less concerned with inflation when compared to the 1970s.

(d) only (a) and (b) of the above are true.

Answer: B

22) The strengthening of the dollar between 1980 and 1985 contributed to a ______ in American competitiveness, putting pressure on the Fed to pursue a more _______ monetary policy.

(a) increase; neutral

(b) increase; expansionary

(c) increase; contractionary

(d) decrease; expansionary

(e) decrease; contractionary

Answer: D

23) A borrowed reserves target is

(a) procyclical because increases in income increase interest rates and discount loans, causing the Fed to increase the monetary base.

(b) countercyclical because increases in income increase interest rates and discount loans, causing the Fed to increase the monetary base.

(c) procyclical because increases in income reduce interest rates and discount loans, causing the Fed to reduce the monetary base.

(d) countercyclical because increases in income reduce interest rates and discount loans, causing the fed to reduce the monetary base.

(e) neutral because economic activity has no effect on incentives to borrow from the Fed.

Answer: A

24) Fed policy since the early 1990s indicates that

(a) monetary aggregates continue to be rejected as intermediate target.

(b) it is pursuing a policy of targeting the federal funds rate.

(c) it is pursuing a policy of targeting the exchange rate.

(d) only (a) and (b) of the above are true.

(e) only (a) and (c) of the above are true.

Answer: D

25) Fed policy since the early 1990s indicates that it is pursuing a policy of targeting the

(a) monetary base.

(b) money supply.

(c) federal funds interest rate.

(d) exchange rate.

Answer: C

26) Starting in February 1994, the Fed

(a) abandoned its policy of keeping the federal funds interest rate target a secret.

(b) lowered the federal funds interest rate target to deal with a possible slowing in the economy.

(c) began

a preemptive strike against inflation by raising the federal funds interest

rate in steps to

6 percent by early 1995.

(d) did both (a) and (b) of the above.

(e) did both (a) and (c) of the above.

Answer: E

27) In early 1996, the Fed

(a) lowered the federal funds interest rate target to deal with a possible slowing in the economy.

(b) abandoned its policy of keeping the federal funds interest rate target a secret.

(c) raised its federal funds interest rate target by 3/4s of a percentage point following the collapse of Long-Term Capital Management.

(d) did both (a) and (b) of the above.

(e) did both (b) and (c) of the above.

Answer: A

28) Between early 1996 and late 1998, the Fed

(a) lowered the federal funds interest rate to deal with a possible slowing in the economy.

(b) took the dramatic step lowering the federal funds interest rate by 3/4s of a percentage point following the collapse of Long-Term Capital Management in the fall of 1998.

(c) kept the federal funds interest rate targeted at a constant 5 percent.

(d) did both (a) and (b) of the above.

(e) did none of the above.

Answer: D

29) International policy coordination exists when

(a) all central banks adopt identical unemployment rate goals.

(b) all central banks adopt identical growth rate goals.

(c) central banks hold exchange rates constant.

(d) central banks adopt policies in pursuit of common goals.

(e) all of the above.

Answer: D

30) According to the Taylor rule, the Fed should raise the federal funds interest rate when inflation _____ the Fed’s inflation target or when real GDP _____ the Fed’s output target.

(a) rises above; drops below

(b) drops below; drops below

(c) rises above; rises above

(d) drops below; rises above

Answer: C

31) The rate of inflation tends to remain constant when

(a) the unemployment rate is above the NAIRU.

(b) the unemployment rate equals the NAIRU.

(c) the unemployment rate is below the NAIRU.

(d) the unemployment rate increases faster than the NAIRU increases.

(e) the unemployment rate falls faster than the NAIRU falls.

Answer: B

32) The rate of inflation increases when

(a) the unemployment rate equals the NAIRU.

(b) the unemployment rate exceeds the NAIRU.

(c) the unemployment rate is less than the NAIRU.

(d) the unemployment rate increases faster than the NAIRU.

(e) the unemployment and the NAIRU increase by equal amounts.

Answer: C