ECON

303 Chapter 17 Study Quiz

1) The Fed uses three policy tools to manipulate the money supply: _____, which affect reserves and the monetary base; changes in _____, which affect reserves and the monetary base by influencing the quantity of discount loans; and changes in _____, which affect the money multiplier.

(a) open market operations; discount lending; margin requirements

(b) open market operations; discount lending; reserve requirements

(c) discount lending; open market operations; margin requirements

(d) discount lending; open market operations; reserve requirements

2) In the market for reserves, an open market ____ shifts the supply curve to the _____ and causes the federal funds interest rate to fall.

(a) sale; left

(b) sale; right

(c) purchase; right

(d) purchase; left

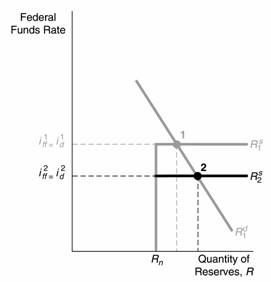

Figure 17-1

3) In Figure 17-1, an increase in the discount rate

(a) shifts

the horizontal section of reserves supply from ![]() to

to ![]() reducing the

equilibrium federal funds rate from

reducing the

equilibrium federal funds rate from ![]() to

to ![]()

(b) shifts

the horizontal section of reserves supply from ![]() to

to ![]() increasing the

equilibrium federal funds rate from

increasing the

equilibrium federal funds rate from ![]() to

to ![]()

(c) shifts

the horizontal section of reserves supply from ![]() to

to ![]() increasing the equilibrium federal funds rate from

increasing the equilibrium federal funds rate from ![]() to

to ![]()

(d) shifts

the horizontal section of reserves supply from ![]() to

to ![]() reducing the

equilibrium federal funds rate from

reducing the

equilibrium federal funds rate from ![]() to

to ![]()

(e) has no effect on the supply of reserves.

4) In Figure 17-1, the vertical section of the supply of reserves is shortened by

(a) open market sales.

(b) a reduced discount rate.

(c) a decrease in required reserves.

(d) an increase in excess reserves.

(e) a cut in the federal funds rate.

5) In Figure 17-1, a decrease in the discount rate

(a) shifts

the horizontal section of reserves supply from ![]() to

to ![]() reducing the

equilibrium federal funds rate from

reducing the

equilibrium federal funds rate from ![]() to

to ![]()

(b) shifts

the horizontal section of reserves supply from ![]() to

to ![]() increasing the

equilibrium federal funds rate from

increasing the

equilibrium federal funds rate from ![]() to

to ![]()

(c) shifts

the horizontal section of reserves supply from ![]() to

to ![]() increasing the equilibrium federal funds rate from

increasing the equilibrium federal funds rate from ![]() to

to ![]()

(d) shifts

the horizontal section of reserves supply from ![]() to

to ![]() reducing the

equilibrium federal funds rate from

reducing the

equilibrium federal funds rate from ![]() to

to ![]()

6) In Figure 17-1, the vertical section of the supply of reserves lengthened by

(a) open market sales.

(b) an increased discount rate.

(c) a decrease in required reserves.

(d) an increase in excess reserves.

(e) a cut in the federal funds rate.

7) Open market sales _____ the _____ thereby _____ the money supply.

(a) raise; money multiplier; lowering

(b) raise; money multiplier; raising

(c) lower; monetary base; lowering

(d) lower; monetary base; raising

(e) raise; monetary base; raising

8) There are two types of open market operations: _____ open market operations are intended to change the level of reserves and the monetary base, and _____ open market operations are intended to offset movements in other factors that affect the monetary base.

(a) defensive; dynamic

(b) defensive; static

(c) dynamic; defensive

(d) dynamic; static

9) If the banking system has a large amount of reserves, many banks will have excess reserves to lend and the federal funds rate will probably _____; if the level of reserves is low, few banks will have excess reserves to lend and the federal funds rate will probably _____.

(a) fall; fall

(b) fall; rise

(c) rise; fall

(d) rise; rise

10) The Federal Reserve will engage in a repurchase agreement when it wants to _____ reserves _____ in the banking system.

(a) increase; permanently

(b) increase; temporarily

(c) decrease; temporarily

(d) decrease; permanently

11) The Fed can offset the effects of an increase in float by engaging in

(a) a repurchase agreement.

(b) a matched sale-purchase transaction.

(c) an interest rate swap.

(d) an open market purchase.

(e) none of the above.

12) The most common type of discount loan, _____ credit loans, are intended to help banks with short-term liquidity problems that often result from temporary deposit outflows.

(a) secondary

(b) primary

(c) temporary

(d) seasonal

13) Secondary credit

(a) plays the most important role in monetary policy.

(b) consists of loans to banks experiencing financial trouble

(c) is given to a limited number of banks in vacation and agricultural areas.

(d) is all of the above.

14) The Fed’s discount loans are of three types: _____ is the most common category; _____ is given to a limited number of banks in vacation and agricultural areas; _____ is given to banks that have experienced severe liquidity problems.

(a) seasonal credit; secondary credit; primary credit

(b) secondary credit; seasonal credit; primary credit

(c) primary credit; seasonal credit; secondary credit

(d) seasonal credit; primary credit; secondary credit

15) The discount rate is ______ kept _______ the federal funds rate.

(a) always; below

(b) typically; below

(c) typically; equal to

(d) typically; above

(e) never; above

16) The interest rate on secondary credit

(a) equals the federal funds rate.

(b) equals the rate on primary credit.

(c) equals the rate on seasonal credit.

(d) is set 50 basis points above the primary credit rate.

(e) is set 50 basis points below the primary credit rate.

17) The interest rate for primary credit typically

(a) equals the federal funds rate.

(b) is 100 basis points above the federal funds rate.

(c) in 100 basis points below the federal funds rate.

(d) is 50 basis points above the secondary credit rate.

(e) equals the secondary credit rate.

18) The interest rate on seasonal credit equals

(a) the federal funds rate.

(b) the primary credit rate.

(c) the secondary credit rate.

(d) the prime rate.

(e) an average of the federal funds rate and rates on certificates of deposits.

19) A financial panic was averted in October 1987 following “Black Monday” when the Fed announced that

(a) it was lowering the discount rate.

(b) it would provide discount loans to any bank that would make loans to the security industry.

(c) it stood ready to purchase common stocks to prevent a further slide in stock prices.

(d) all of the above.

20) The most important advantage of discount policy is that the Fed can use it to

(a) precisely control the monetary base.

(b) perform its role as lender of last resort.

(c) control the money supply.

(d) punish banks that have deficient reserves.

21) Disadvantages of discount policy include

(a) the fact that banks, and not the Fed, determine how much to borrow.

(b) large fluctuations in the money multiplier from even small changes in the discount rate.

(c) its powerful effect, when compared to open market operations, on reserves and the monetary base.

(d) only (a) and (b) of the above.

22) Disadvantages of discount policy include

(a) the fact that the lender of last resort function creates a moral hazard problem.

(b) banks that are “too big to fail” may take excessive risks.

(c) the fact that the Fed cannot precisely control the amount of discount lending.

(d) all of the above.

(e) only (a) and (b) of the above.

23) The Fed is reluctant to use reserve requirements to control the money supply and interest rates because

(a) they have the potential to create lending problems for banks with high excess reserves.

(b) frequent changes in reserve requirements complicate liquidity management for banks.

(c) of their weak impact on the money supply.

(d) of only (a) and (b) of the above.

24) The global reduction in reserve requirements

(a) increases bank costs.

(b) decreases bank profits.

(c) increases bank competitiveness.

(d) increases moral hazard.

(e) all of the above.

25) In a lombard facility

(a) a central bank restricts bank borrowing by aggressively changing its lending rate.

(b) a central bank restricts bank borrowing by regulation.

(c) a central bank does not limit borrowing.

(d) a central bank does not make loans to banks.

(e) a central bank makes loans to banks at a zero interest rate.

26) If the overnight interest rate rises above the lombard rate

(a) banks stop borrowing from the central bank.

(b) the central bank supplies any amount of loans that banks want.

(c) the central bank refuses to lend.

(d) banks increase their deposits at the central bank.

(e) the overnight interest rate cannot be controlled.

27) If the overnight interest rate falls below the rate paid on reserves

(a) banks stop lending to the central bank.

(b) the central bank supplies any amount of loans that banks want.

(c) the central bank refuses to lend.

(d) banks increase their deposits at the central bank.

(e) the overnight interest rate cannot be controlled.

28) In the channel-corridor system

(a) control of the overnight interest rate is impossible.

(b) reserve requirements are essential for monetary control.

(c) the overnight rate always equals the Lombard rate.

(d) allows for monetary control with no required reserves.

(e) all of the above.